Homeowner Appraisal Inspection Tool

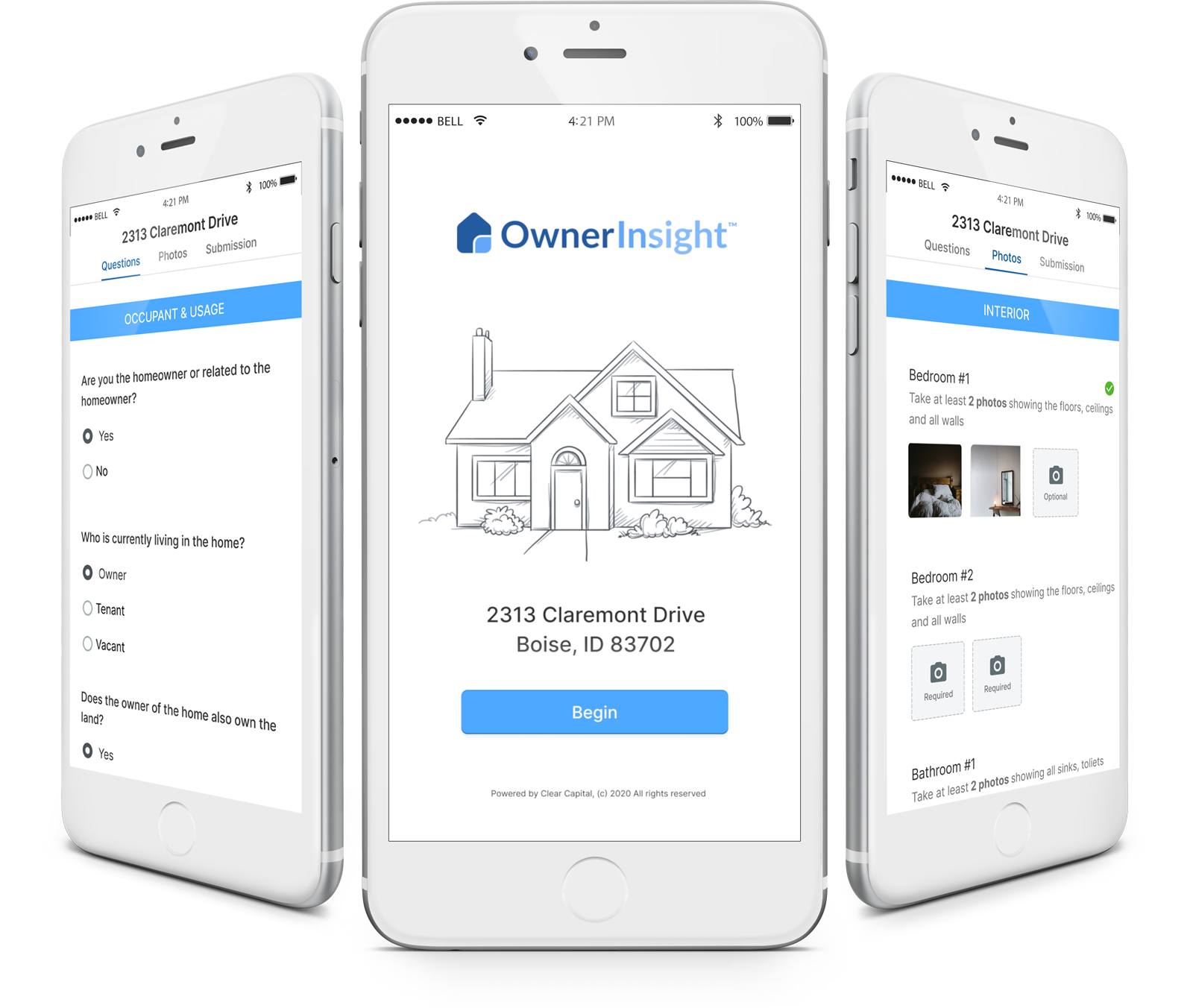

A simple, free and secure way to quickly request and receive interior appraisal info and photos from home occupants. All you need is a property address and the occupant's contact information, and you can get started right away.

Simple web-based ordering

A short web-based order form to request inspections from homeowner or occupant

Eliminates Scheduling

No need to schedule an appointment or speak with the homeowner.

Improves Inspection Consistency

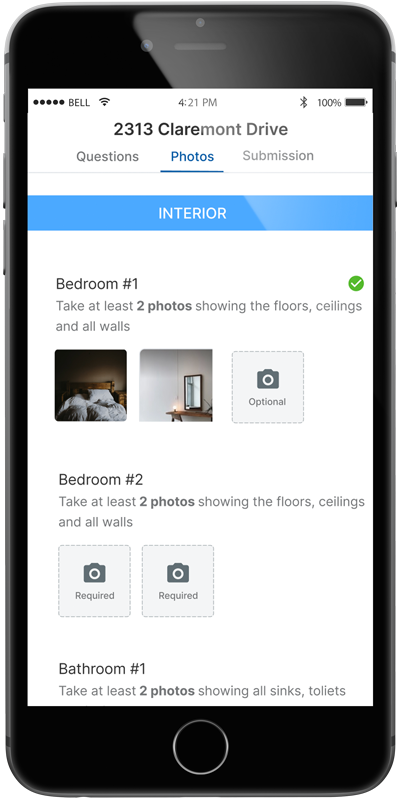

All data and images are presented in a standard sequence.

Protects Earnings

Complete COVID-19 agency desktops and exterior-only appraisals.

Comply with COVID-19 Orders

Enables all appraisers to continue working and comply with government orders.

Satisfies Agency & Govt. Guidelines

Allowable under the COVID-19 FHFA, FNMA, FHLMC, VA and FHA guidelines.

Built to

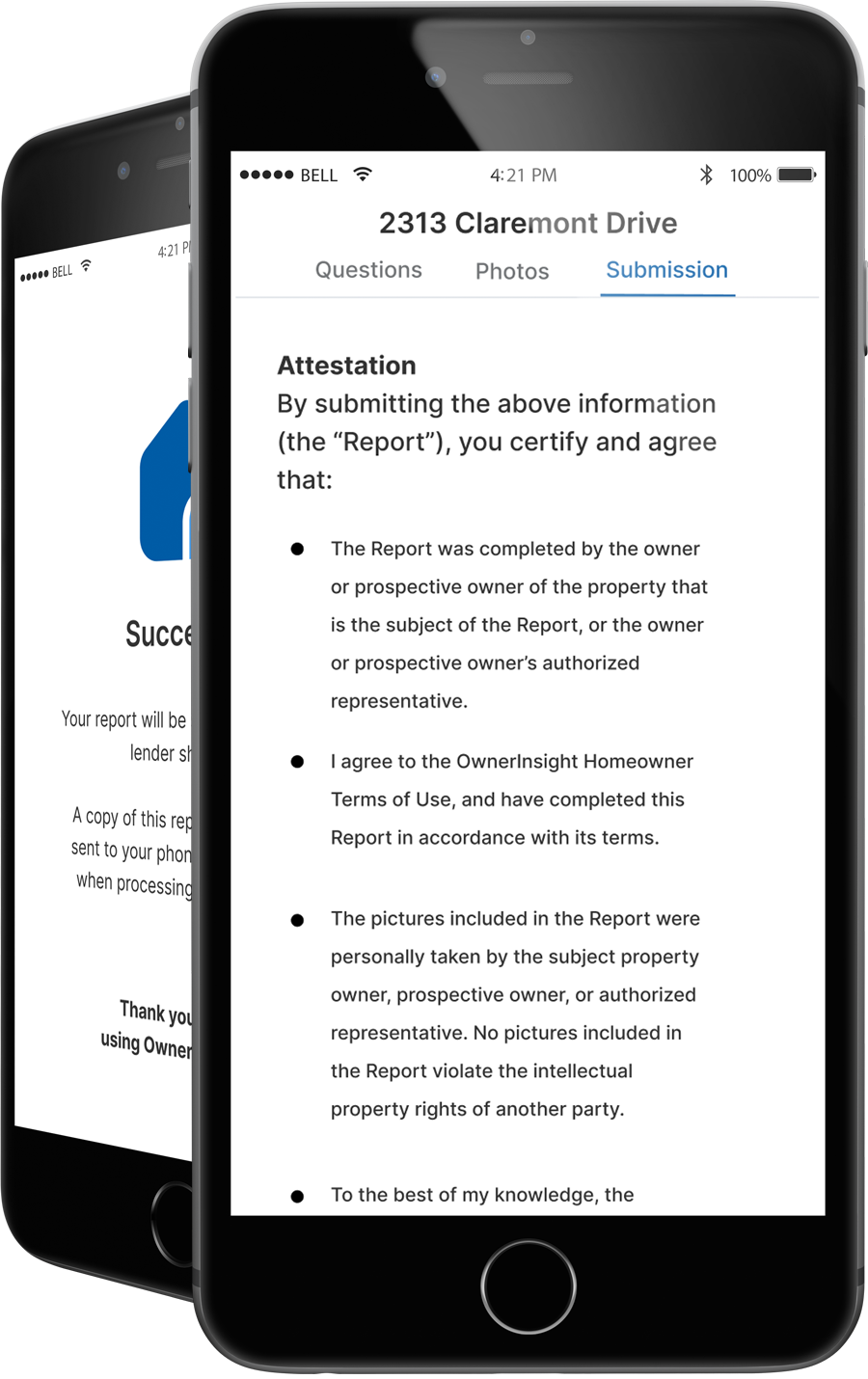

Mitigate Fraud

Real-time, geolocated and time-stamped images protect against fraudulent use. Homeowner/Occupant required to certify and agree that they have disclosed all materials facts and the information is true and correct prior to submission.

Easy-to-use

Homeowners receive a text link to start immediately. No downloads.

Homeowner Attestation

Homeowners certify and agree that they have disclosed all materials facts and the information is true and correct

Inspection in 15 minutes

On average, homeowners are able to complete the the inspection in 15 minutes, or less.

Free!

OwnerInsight™ is available free to lenders, appraisers, service providers and AMCs

OwnerInsight in the News

Since its launch, OwnerInsight has received a wonderful amount of media coverage. Check out some of the articles below.

User Feedback

Below are some testimonials from both appraisers and homeowners.

It helps keep us healthy

Some lenders are demanding interior photos. I commend you and your company for putting this product together as it helps keep us healthy.

Brent Collier

Appraiser, KentuckyIt is very cool

I tested out the product, and it is very cool and thorough.

Adam Weiner

AppraiserI love the new product

I love the new product and I am so excited for more to come from Clear Capital!

Victoria Gill

AppraiserShe was really happy...

The borrower is 8 months pregnant. She was really happy this feature was available due to concerns regarding her pregnancy, and that her recent upgrades to the home will be accounted for; with a normal drive-by appraisal we wouldn't know.

Mat Lawrie

Appraiser, Clario Appraisal, SacramentoIt looks really powerful!

I'm excited about this product and it looks really powerful!

David Loberg

Metrolina Appraisal GroupThis is a great tool

I just got my first report back from the homeowner. They finished it and sent it in less than 30 minutes after I requested it! This is a great tool.

Scott Lowe

AppraiserSo excited...

So excited to do my own inspection.

Stephanie

HomeownerHandy tool throughout the COVID-19 pandemic

Owner Insight has been such a handy tool throughout the COVID-19 pandemic. Our firm has appreciated the ability to provide a simple solution to protect our appraisers and homeowners while still being to obtain information to assist the appraiser. It’s also been impressive to engage with high quality customer service and their ability to quickly make updates to improve the product. I would definitely recommend this product to appraisers!”

Kelly Dowling

Appraiser, ArizonaFrequently Asked Questions

For further support, please call 530.414.7069

Can I use OwnerInsight on all my assignments?

Yes. OwnerInsight can be utilized to provide supplemental information on any report. However, OwnerInsight can only be used in lieu of a physical inspection on specific orders with the approval from the lender/client. These GSE and FHA approved forms require use of modified Scope of Work, Statement of assumptions and Limiting Conditions, and Certifications.

Is OwnerInsight USPAP compliant?

Yes, providing the appraiser reasonably believes the information provided to be reliable, it may be used in the report in accordance with USPAP. The appraiser must ensure that the degree of inspection is sufficient for the appraiser to understand the subject property’s relevant characteristics, so the appraiser can develop a credible appraisal.

Additionally, per USPAP, the appraisal must contain a signed certification that clearly states whether the appraiser has or has not personally inspected the subject property.

Does the lender, AMC or appraiser order the OwnerInsight inspection?

OwnerInsightTM can be ordered by the lender, AMC and appraiser, depending on the process that your lender and AMC implement. Clear Capital makes OwnerInsightTM available through a website order form at getownerinsight.com and API access at https://docs.api.clearcapital.com/

Does my lender allow the use of OwnerInsight?

Please check with your lender directly as their credit policy may differ for agency and non-agency loans. Guidance for lenders and appraisers is available from Fannie Mae and Freddie Mac, FHA/HUD, USDA and VA.

Do I still need to do an interior inspection if I use OwnerInsight?

OwnerInsight homeowner inspections do not automatically replace the need for interior inspections. Specific loan criteria dictate whether an in-person appraiser interior inspection is required or if an alternative desktop or exterior only option is allowed. Knowing the loan details, the lender/client will determine the appropriate appraisal type.

What does Clear Capital do with the data and images?

Clear Capital retains the rights to the data and images collected with the OwnerInsight inspection. We provide a limited, non-exclusive, revocable, license to use the Information in the report as well as the services, for the purpose of facilitating a valuation or inspection report on the subject property.

Why don’t you charge for OwnerInsight? When do you plan to start charging?

Clear Capital developed OwnerInsight to support our clients, appraisal partners and the mortgage industry during this unprecedented time. We are providing OwnerInsight as a free tool and service to keep industry participants safe and help qualified mortgage transactions move forward. There are no plans to start charging for OwnerInsight.How are you safeguarding the security and privacy of the data and images?

OwnerInsight has appropriate administrative, technical, and physical safeguards to protect the security, confidentiality, and integrity of customer information.What investors have approved OwnerInsight?

Multiple lenders and investors are already utilizing OwnerInsight in their appraisals today. Please check with your lender/client directly to see if OwnerInsight is appropriate for a particular order.What financial regulators and agencies have approved OwnerInsight?

In accordance with USPAP and with reference to the recent GSE, FHA and VA guidance, there is no requirement for regulators or agencies to specifically approve OwnerInsight. Appraisers may speak to and gather information from property homeowners, occupants points-of-contact, etc, in the formulation of their reports.

When will OwnerInsight be available for other valuation products?

The plan is that OwnerInsight will be used by real-estate professionals to collect information, data and images to augment alternative valuation products.Can OwnerInsight be used on other property types, such as commercial, multi-family and condos?

OwnerInsight is designed for residential properties. In addition to single family residences, it can be used to inspect condos, and townhomes. It could also be used for data collection and photos on 2-4 unit properties.Can I use OwnerInsight reverse mortgages?

Yes, the FHA is allowing appraisal flexibility on Reverse HECM mortgages as well as Forward mortgages. The appraisal requirements depend on the loan type and other factors, so please check with your lender if you have questions about the order.

Want to know more?

Complete the form below to schedule some time to chat with an OwnerInsight specialist who can answer all of your questions!